| 作者 |

留言 |

Charles

年龄: 42

注册时间: 2005-03-15

帖子: 17

来自: Hamilton

|

|

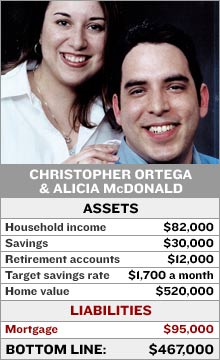

Cash only please Christopher Ortega and Alicia McDonald have shaken their debt by buying only what they can afford.

NEW YORK - At the end of the evening, when it's time to settle the check or close the bar tab and most people reach for the plastic, Christopher Ortega just says no. NEW YORK - At the end of the evening, when it's time to settle the check or close the bar tab and most people reach for the plastic, Christopher Ortega just says no.

It's not like Ortega is trying to stiff anyone. It's just that after years laboring under consumer debt, he and his long time girlfriend Alicia McDonald have used a cash-based strategy to finally emerge into the land of checkbook surpluses.

And they're emerging with the tenacity of a well-seasoned debt collector.

The 28-year old independent financial planner and 27-year old McDonald, a title officer, are just a few payments away from wiping out nearly $35,000 in commercial debt. At that point they plan on socking away an additional $800 a month on top of the $900 a month they are currently saving. Combine that with the $420,000 the couple has in home equity and they'll be millionaires by the time they're 45.

"All of a sudden we're talking about saving $1,700 a month,' said Ortega. "The benefits of being on a cash system really pay off."

Like many people, the couple got into debt during college when there were lots of expenses and little time for work.

To dig themselves out they have had to scale back on some things and put off others, including marriage.

"We could have brand new cars and make sure the wedding is completely funded and do a bunch of landscaping in the back, but we'd have to make all these payments to these financial institutions that don't really benefit us," said Ortega. "Sometimes we just have to wait a little longer."

Before taxes the couple makes about $82,000 a year, or $6,800 a month. Their monthly budget looks like this:

$1,700 in taxes

$500 for insurance (health, car, mortgage, life)

$1,700 for the mortgage, a second mortgage and the remaining consumer debt

$2,000 spending money

$900 for saving

The extra $800 in savings, which will bring the couple up to $1,700 a month, will come when the remaining consumer debt is paid off in the next few months and from diverting some tax money to invest now and relying on a mortgage tax refund to make up the difference later.

Ortega plans on adding the extra money to a simplified employee pension (SEP), a kind of 401(k) for the self employed. That will complement the $500 a month they are already stashing into their IRA and $400 a month they put into an emergency savings fund.

Granted, much of their wealth is based on the paper value of their home, which they purchased in 1998 for $114,000. The three bedroom house, to which they recently added a 700 square foot addition to for Ortega's parents, is now worth around $520,000.

Located in Modesto, Calif., 90 miles south of Sacramento, Ortega says real estate prices in the area have benefited from people moving from the San Francisco area to places inland, as prices on the shore have grown even more.

He says they were extremely lucky to buy when they did, and credits his mother, a real estate agent, for spurring their decision.

"She said 'This area is going to be another San Jose, buy,'" he said.

Ortega says his main motivation for saving is to avert any financial troubles further down the road. He said his parents had a hard time making ends meet and he wants to make sure he and Alicia, who have been sweethearts since high school, don't end up in similar circumstances.

"It's very important for me to know that she won't have to struggle with money," he said.

|

|

|

|

|

|

|

|

|

想当理财高手

注册时间: 2005-01-14

帖子: 25

来自: 北京

|

|

Millionaires, luv that 401(k)

Couple raises kids, pays the mortgage, saves half a million.

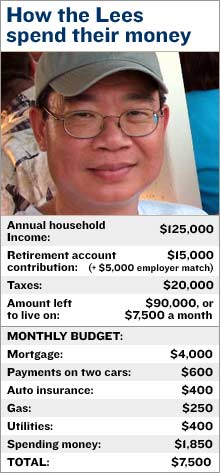

LA, CA - Most people move into a bigger house when they have kids.

Not the Lees. To both give their two children a good education and continue saving for retirement, 13 years ago the Lee's downsized from a new 3,200 square foot, 5-bedroom colonial to a 30-year-old, 2,200 square foot four bedroom home. Not the Lees. To both give their two children a good education and continue saving for retirement, 13 years ago the Lee's downsized from a new 3,200 square foot, 5-bedroom colonial to a 30-year-old, 2,200 square foot four bedroom home.

48-year old Han-Lin Lee and his wife managed two kids, a house and $500,000 in the bank on $125,000 a year.

The smaller house was in a better school district and thus avoided the need to send the kids to expensive private schools. Instead they plowed that money into their 401(k)s.

Now, despite the costs of raising two children and a comfortable-but-not-excessive annual household income of $125,000, they sit on half a million dollars in savings. And that doesn't even count the $500,000 they have in home equity.

"It doesn't take a rocket scientist to figure out that a 401(k) is a pretty good deal," said 48-year old Han-Lin Lee.

Han-Lin and his wife, Fu-Lin, met at graduate school in Illinois. They both had come over from Taiwan and had won scholarships to study -- she educational psychology, he civil engineering.

At the age of 30, soon after Han-Lin got his first job out of school with an environmental consulting firm, the couple bought a town house for $97,000.

Although Han-Lin was making only $35,000 a year, he contributed 10-12 percent to his 401(k), which also had a company match of 4 percent. Before long, and with regular raises, he was socking away nearly $14,000 a year.

The couple had their first child, a boy, in 1988. A year later they sold the town house and bought the big colonial for $242,000. By this time Han-Lin said he was making more money, and with Fu-Lin's paid internship they were bringing in $60,000 a year.

In 1992 Fu-Lin got a job as a counselor at George Mason University. The Lees also had another child by then, a 2-year-old girl.

"I looked around and figured I probably needed to downsize just to get to a better school district," said Han-Lin.

So they traded the big colonial in Lanham, Md. for a smaller house in the nicer neighborhood of McLean, Va. But the housing slump of the early 90s took its toll and they had to rent out the colonial until they finally sold it 1996 for $200,000, a loss of over $40,000.

Nonetheless, the Lees persisted with their 401(k) contributions, maxing them out each year and getting the full employer match.

In 2004, with the housing market hot, they finally decided to trade up. They sold the 2200 square foot house for $680,000, more than twice what they paid for it, and bought a 4,000 square foot, six bedroom home for nearly $1 million also in McLean.

Now they juggle a mortgage, for which they pay a hefty $4,000 a month. Fu-Lin has her own psychology practice so it's just Han-Lin contributing $15,000 a year to his retirement plan, which changed to a Thrift Savings Plan with a $5,000 match when he took a job as a Department of Energy analyst.

And their kids, now age 15 and 18, are looking at college.

Although the Lees never set up a separate college savings plan, they aren't worried.

Han-Lin said he was more comfortable saving his money in retirement accounts or in real estate than using a separate college savings account.

He said they will pay for college through a variety of means, including scholarships, loans, raises at work and part time jobs for the kids.

"I'm kind of still playing it by ear right now, keeping my options open," he said.

He also pointed to Virginia's well-regarded public universities and said his kids might go to one of them, helping to keep the costs down.

Over the next ten years, through a combination of continued 401(k) investment, paying off the house and stock market appreciation Han-Lin expects to double the family's assets to over $2 million.

And after that?

"I'm going to travel to a lot of places but not spend a lot of money," he said.

|

|

|

|

|

|

|

|

|

Charles

年龄: 42

注册时间: 2005-03-15

帖子: 17

来自: Hamilton

|

|

To millionaire status...and beyond

Paul and Audrey Yazbeck are taking control of their money and they're having fun doing it.

NEW YORK - Before you become convinced America's youth is woefully unprepared for financial reality, meet Paul and Audrey Yazbeck.

Paul, 25, and Audrey, 24, have already socked away more than $125,000. Audrey is an accountant, and Paul, who attended college on an Army scholarship, currently is serving as an Army officer. Paul, 25, and Audrey, 24, have already socked away more than $125,000. Audrey is an accountant, and Paul, who attended college on an Army scholarship, currently is serving as an Army officer.

At the rate they're saving, the Yazbecks will be millionaires well before retirement. But they're setting their sights beyond the millionaire mark.

"Our main goal is financial freedom. It's all about keeping our options open," Paul said.

While taxable accounts, Roth IRAs and 401(k)s may be hobgoblin to most twenty-somethings, the Yazbecks know the ins and outs of each of these financial planning products.

Early bird gets the worm

They also understand the importance of saving early. "Each positive money move we make now compounds into more positive results for the future," Audrey said.

The couple intends to have children down the road, and they'd like to have the option of having one parent stay at home in the future.

They saved $50,000, or about Paul's entire paycheck, last year and are setting a similar target for 2006.

Besides shaving everyday costs by brewing coffee at home and bringing their lunch to work, they also act on every saving opportunity.

Take the mortgage on the town home they bought in Georgetown, Texas, which is about 20 miles north of Austin. Take the mortgage on the town home they bought in Georgetown, Texas, which is about 20 miles north of Austin.

Originally they had a 30-year fixed mortgage, but refinanced when a three-year adjustable-rate mortgage at a lower rate became available.

Adjustable-rate mortgages can be riskier than fixed-rate ones because rates can increase over the lifetime of the loan. But since the couple plans on selling the house within the next three years, the refinancing seemed like a smart choice, they said. They expect the refinancing to save them about $2,500.

Budget for success

Each month the Yazbecks -- who make about $115,000 a year, or $9,600 a month before taxes -- carefully budget their expenses and track their spending.

They earmark about a third of their income for investing, and most of these dollars go to maxing out their 401(k) plans and making regular contributions to their Roth IRAs. About 90 percent of their savings are invested in stocks and mutual funds, but they're also considering diversifying away from equities.

While the Yazbecks are meticulous about their budget, they don't let it rule their life. "We're not bound by it, but use it to guide and track our goals," Audrey said.

Money can be a sore point for many couples, but the Yazbecks avoid conflict by working together on their financial roadmap.

Paul has found such satisfaction in planning that he is considering becoming a certified financial planner when he's eligible to leave the Army. "The future looks really bright," he says.

|

|

|

|

|

|

|

|

|

想当理财高手

注册时间: 2005-01-14

帖子: 25

来自: 北京

|

|

Millionaire in the making

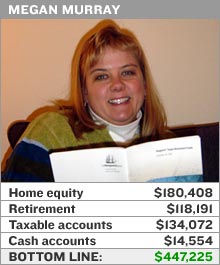

Civil servant and reservist Megan Murray is marching towards a secure retirement.

Houston,TX - Is it possible to get rich in the army? Megan Murray thinks so. Houston,TX - Is it possible to get rich in the army? Megan Murray thinks so.

Murray, 38, joined the military on an ROTC scholarship at Northern Illinois University. She became an officer after graduation and spent three years in active duty before transferring to the reserves.

Financially, Megan is in good shape, with a net worth totaling $447,225. It isn't just the paycheck that got her there -- a keen interest in personal finance played a big role.

A near 17-year veteran, Megan intends to stay, at the very least, another six years in order to qualify for a military retirement. (Service personnel need 20 years of service, but Megan spent three years on inactive status training for her civilian career, in civil aviation security.)

Two years ago, Megan was called up for active duty. She's bringing home nearly $68,000 annually during the deployment, plus an estimated $2,600 each month from her non-taxable food and housing per diem.

The math works out to be about $16,000 less than the $115,000 she makes when working and doing reserves part-time, but she doesn't seem to mind.

"I intend to go as long as possible," she said. "We don't make huge salaries in terms of what can be made in America. But our work is so important that I want to make my life out of it."

Assets in reserve

Megan's military pension is based on the number of years she spends in the reserves and the number of points she earns doing active duty. Assuming she's never deployed again, her monthly retirement payout would equal some $1,800 in today's dollars by the time she is 60.

That pension isn't her only means of retirement income, either. Megan maximizes her contributions to a thrift savings plan, or TSP, which she defines as the federal equivalent to a 401(k).

"There are three parts to our retirement savings program: TSP, Social Security, and the pension," she explains. "The TSP has the biggest potential."

Megan qualifies for two different TSP plans because she is a federal employee and reservist. She receives a 5 percent match from her civilian plan -- the army plan doesn't have a match -- but she can't make contributions to her civilian plan while deployed.

She also stashes the maximum allowed in her Roth IRA, bringing her total retirement savings to $118,191. The core of her portfolios is invested in mutual funds, mostly Vanguard.

Megan has a separate stock account, worth $14,554, but plans on moving her money into a fund. "With the amount of time it takes me to research it, it's better for me to invest in mutual funds," she says.

She links all her accounts through Vanguard so that she can track them and review her allocations each month. She earmarks her mid-month paycheck for investing and has it automatically deducted from her checking account.

Her next move may be in real estate. Her Las Vegas-area home has appreciated considerably in the past couple of years, but she is looking at different prospects across the country.

Megan owes about $119,590 on her 15-year mortgage, but with a 5.25 percent interest rate she sees no need to pay it off early.

Drilling it home

Megan has no debt outside her mortgage and never carries a balance on her Discover card. Student loans aren't a problem either, as the army is also picking up the tab for her MBA at the University of Illinois at Chicago, where she is studying part-time.

When she leaves the army Megan wants to be a financial adviser or counselor, in part because of all the fun she's had managing her own money.

"People should have as much fun with their investments -- shopping for investments -- as shopping at the mall," Megan stated.

It's a habit that builds net worth. That's one of the reasons why the sale-only shopper frequents Wal-Mart and Kohl's rather than higher-priced boutiques.

One of her savvier purchases was a 2003 Honda hybrid that allowed her to take a $2,000 tax deduction the year she bought it. She doesn't budget for gas anymore, although it will take her a couple of years to recoup the difference between the higher sticker price and gas savings.

Megan also takes full advantage of many of the discounts military life has to offer, such as free dental and medical care as well as discounted insurance through USAA.

Holding onto her earnings is her No. 1 priority, but stresses that investing early is just as important.

"Make wise decisions now, and it will pay off," she said. Good lesson.

|

|

|

|

|

|

|

|

|

想当理财高手

注册时间: 2005-01-14

帖子: 25

来自: 北京

|

|

Millionaire in the making

Good habits are hard to break

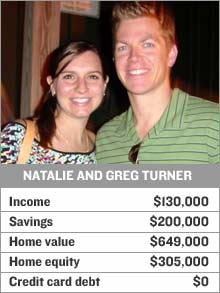

With a baby on the way, Natalie and Greg Turner put saving first...and Pearl Jam second.

Fort Worth, TX. Some people get a thrill out of spending -- the Turners are excited to save. Fort Worth, TX. Some people get a thrill out of spending -- the Turners are excited to save.

Natalie, 27, and Greg, 28, first met at Clemson University in South Carolina six years ago, they fell in love and moved to Charleston shortly after graduation. They bought a home together, then got married and are now expecting their first child.

Life is sweet for the young couple but they've worked hard to make it that way.

Greg, a pharmaceutical salesman, and Natalie, a software engineer, make a combined annual income of $130,000. Even though their net income affords them a comfortable lifestyle they have made saving their first priority.

"My husband, Greg, and I make it a game to see how much money we can stash away in savings and mutual funds," Natalie said.

"He invests 19 percent of his paycheck, while I put 15 percent into retirement, but we also put aside about $12,000 a year into mutual funds and always have at least a year of living expenses saved up just in case of an emergency."

So how do they manage to sock so much away?

The couple are modest spenders, Greg uses a company car so they only own one car between the two of them which has been paid off for a few years. They do most of their shopping at Costco and Natalie admits she has even curbed her clothing expenditures thanks to Greg's influence.

They recently splurged on new baby furniture for the nursery but Natalie and Greg never put more on their credit cards then they can pay off at the end of the month.

And they still allow for at least one nice vacation a year and one other indulgence -- Pearl Jam. They make time for concerts whenever and wherever they can.

Next up the couple is heading to Cabo San Lucas for a romantic getaway before baby makes three. Natalie says they will use hotel points and frequent flier miles that they have earned from frequent business trips.

Any extra income, including bonuses and monetary gifts from family, goes directly into an investment or savings account, and they plan to start a 529 college savings plan with the money they expect to receive from their families after the birth of their child.

The only exception has been their tax refund -- which they've spent on new floors, new countertops and other upgrades to their home, which they recently sold for $480,000 -- more than twice what they bought it for three years ago

They used the money from the sale as a downpayment on a four bedroom in the same neighborhood. Natalie says they didn't intend to turn their house over so quickly but with a baby on the way, "it was a good time to upgrade."

But even with a new house and new baby, don't expect the Turners to slack off on saving.

"It's great to be able to live and enjoy life, knowing that 30 years from now, we will be able to enjoy it even more!"

|

|

|

|

|

|

|

|

|

Charles

年龄: 42

注册时间: 2005-03-15

帖子: 17

来自: Hamilton

|

|

Millionaires in the Making: The Marchbanks

Matt and Lori have managed to build $300,000 together just a few years out of college, and not by cutting back on life's pleasures.

Dallas, Texas -- If the idea of saving away 25 percent of your paycheck makes you think of a severely cramped lifestyle, meet the Marchbanks of Dallas, Texas. Dallas, Texas -- If the idea of saving away 25 percent of your paycheck makes you think of a severely cramped lifestyle, meet the Marchbanks of Dallas, Texas.

Matt, who works on real estate and small business lending at a commercial bank, and Lori, an accountant, have a shared financial philosophy that lets them spend confidently - and save diligently.

The couple met in high school and dated throughout college at Texas A&M, marrying two weeks after their 2000 graduation. Now, at the ages of 28 and 27, Matt and Lori have over $300,000 in assets.

"We were both fortunate to get great jobs out of school," says Matt. "Our parents paid for college so we didn't start with any debt."

How they save

The Marchbanks take home a combined salary of $145,000, plus annual bonuses of around $40,000. But a good salary doesn't always mean good savings. With mortgage payments on a beautiful 2000-sq.-foot home, and a confessed preference for nice cars, how does the couple save as much as they do?

"We share a philosophy: we can afford a lot more, but we choose to pay ourselves first," he says. "When we're 55, we want to be the ones to decide if we continue working, or take part-time jobs or just travel. Nothing beats saving when you're young so you can get ahead with the power of compound interest."

Accordingly, Matt and Lori set aside just over 25 percent of their income each month. They both max out their 401(k)s at work, taking advantage of company matches. Each year they have put the maximum possible into their Roth IRAs before hitting the government's income limit last year.

Beyond that, they don't really operate with a strict budget - more like strict values.

They pay off credit cards every month, so their only debt is their mortgage, and Matt says interest rates are a major concern of theirs.

He says he learned his good financial habits from his father, an insurance salesman, and mother, a school teacher.

The couple has over $100,000 in their combined 401(k)s, and $50,000 in Roth IRAs. They have around $100,000 in cash in savings accounts, and $40,000 in home equity.

Matt says the large cash holding is eventually going to be invested - he'd prefer to have only 25 percent in cash as an emergency fund. But he's currently interviewing different investment advisers before putting the bulk of the cash into the market.

How they spend

One of Matt's big indulgences is his golf game, but he often gets to play while entertaining bank clients.

Matt also views negotiating prices as a crucial skill in his financial repertoire. "I almost never take the first price on anything, whether it's haggling or asking for discounts," he says. "I do a lot of negotiating in my job, so I'm more comfortable with it than many people. I'll never pay sticker price for a car, for instance, because to me there's always wiggle room."

Cars are one purchase that Matt feels especially strong about.

"I drive about 25,000 miles a year so I want to drive something I like," he says. "We definitely splurge a little there."

In purchasing Lori's car, one of the couple's biggest expenditures, he negotiated a price below the invoice and a very low interest rate.

Her '05 Acura TL is the only car the couple has bought new. Matt drives a used vehicle - an '03 Infiniti G35 that he bought with low mileage.

The future

What's ahead for the penny-conscious couple? A child, and perhaps a new home.

"We'd like for Lori to stay home for quite a while after the first child, and maybe not go back to work full-time," he says. He says that there is a lot of flexible work in her field, accounting, and that will give the couple more options after they have children.

"I don't expect to be able to save as much after that - maybe just 10 to 15 percent - but that will be fine," he says.

Matt says a new home may be in the works if their current place begins to feel small for a family of three.

"We're definitely thinking about upgrading in the next two to three years, but it all depends on whether interest rates are favorable," he says. "I've got a 5.25 percent rate for 30 years right now."

He'd also like to add some real estate to the family's portfolio, purchasing some land or rentals.

Despite some major financial burdens ahead, don't expect the Marchbanks to give up their saving ways.

"We're really not penny-pinchers," says Matt. "I think we just really think over our financial decisions. We have a strong common focus that moves us toward our goal."

|

|

|

|

|

|

|

|

|

想当理财高手

注册时间: 2005-01-14

帖子: 25

来自: 北京

|

|

Millionaires in the Making: The Johnsons

Matt says he's squandered his money on cars and even a tattoo. But with wife Kristina's discipline, the couple is on their way to financial security.

Portland -- Matt Johnson can remember a time when he was barely in control of his money, let alone in command of it. Portland -- Matt Johnson can remember a time when he was barely in control of his money, let alone in command of it.

"At one point in college I spent my last $80 on a tattoo," Matt said. "It just seemed like a great thing to buy at the time."

Matt Johnson was in the habit of buying a brand new car every two years before he met wife Kristina.

He was also in the habit of buying a brand new car every two years, going through four cars between 1997 and 2003.

"But Kristina has really helped me change because she approaches money in such an organized way," he said.

Matt met future wife Kristina in their sophomore year at Maryland's Villa Julie College, and they got engaged soon after graduation in 1998. Kristina was an accounting major, and applied some fiscal discipline to Matt's previously free-spending ways.

Now married, Kristina takes care of all the budgeting and bills, and Matt handles the investing.

"We rein each other in," said Matt. "I have a thing for cars, and she has a weakness for shoes and clothes. But we do a good job of keeping each other grounded."

"I don't think we've ever had a serious argument about money," he said. "Well, maybe once we had to have a talk about cars."

The couple has also managed to stash away $200,000 and built up over $120,000 in home equity - and they're both just 30 years old.

How they save

It doesn't hurt that Matt and Kristina take home a combined $147,000 a year - but that alone doesn't keep their finances in good shape.

"We're big believers in doing paycheck deductions - don't even let that savings money into your bank account," said Matt. "It's the whole idea of not even seeing the money."

They both began contributing to their 401(k)s as soon as they began working. Matt became well-acquainted with the culture of saving while working in the 401(k) division at T. Rowe Price as a communications consultant. And Kristina built her budgeting skills while working as an accountant, spending five years doing auditing work for Bank of America.

Currently, Matt puts 10 percent of his income towards his 401(k) - with a plan of increasing his contribution one percentage point each year - and Kristina contributes five percent at her current job at Bay National Bank.

They're still trying to figure out how to invest $65,000 that they have in cash. Some of it they are slating for home improvements on their new home in Parkton, north of Baltimore, and some will go towards a diversified investment portfolio.

And they've kept their regular expenses to a minimum, starting off their marriage living in an affordable apartment while looking for a townhouse. Rather than renew the lease, the couple moved in with Kristina's parents for several months while they continued the home search. ("We probably wouldn't repeat that decision," said an older and wiser Matt.)

He describes Kristina as a "total coupon freak," and says the couple save 15 to 20 percent off their grocery bills most weeks.

With the birth of Nicholas earlier this year, the couple put $1,000 into a 529 college savings, and decided to allot one percent of Matt's paycheck this year, with a plan to increase that amount each year.

Both of their jobs offer annual bonuses, but the couple are putting those toward paying off their mortgage.

How they spend

Kristina says the adjustment between Matt's formerly free-spending ways and her budget-balancing accountant side wasn't as hard as it might seem.

"We didn't live together before we got married, so we definitely went through an adjustment period," said Kristina. "But we agreed when we got married that we didn't want to live life extravagantly, although we do enjoy traveling and going out to dinner with friends sometimes."

When the couple jumped and bought a townhouse near Baltimore in 2000, they made sure they weren't maxing out their budget.

"We paid $156,000 for the house - which felt like a lot of money at the time - but then we sold it in 2005 for $308,000," said Matt. "It's the best investment we didn't know we were making."

They found their new house one year ago, while Kristina was several months pregnant. They were just casually looking for homes, sending pictures back and forth online, waiting for the right combination of house, neighborhood and school system.

When Matt found it, the couple made the biggest long-term investment of their life, putting $50,000 down on it and took out a mortgage for $500,000.

They are currently paying about $3200 a month, but are hoping to pay the mortgage down as quickly as possible by steps like applying their bonuses to it.

"Had we not been as fiscally conservative over the years, there's no way we would've been able to do this," said Matt. "We did sell high, but we also had to buy high."

The couple also kept credit card expenditures to a minimum, while not forsaking plastic completely. "We've never paid a finance fee on a credit card," said Kristina.

They do put cards to work for them, however. "We use a Marriott credit card, and we haven't paid for a hotel room in five years," said Matt. "We're going to Las Vegas in early November, and we're doing it on my flight points and her hotel points."

And to satisfy their travel itch, they've vacationed in Italy, Hawaii, Mexico and England.

Matt's car habit has been happily curtailed, and he professes happiness at driving (and frequently sharing) a 2003 Toyota Highlander that they bought new. And Kristina drives a '98 Acura Integra. The cars are completely paid off.

When Kristina returned to work after giving birth to Nicholas, the couple also confronted the reality of day-care payments, to the tune of $1,000 a month.

"It's definitely worth the flexibility, but it does hurt the pocketbook," said Matt. "But the provider is top-notch and we knew if we were going to spend the money, we were going to do it right."

The future

The future is full of options for the couple, and that's just the way they've planned it.

Both of them want to keep indulging their passion for travel, and Kristina is thinking about opening her own business some day.

"I used to dance ballet, and someday I'd love to open my own dance studio," she said.

With all the details of their financial life, it's baby Nicholas that's taking their attention now. "Having the baby around, you definitely refocus what you spend money on, and how you want to spend your life," said Kristina. "We're thinking about money, but also about finding time for Matt and I to just hang out."

|

|

|

|

|

|

|

|

|

想当理财高手

注册时间: 2005-01-14

帖子: 25

来自: 北京

|

|

The Aroras: Millionaires in the Making

Sid and Divya took their honeymoon nine months late to make sure it didn't dent their budget...one sign they have their priorities in order.

Houston,TX -- Sid and Divya Arora recently returned from a beautiful honeymoon in Hawaii, taking a leisurely cruise through the islands. Only thing is, they waited nine months after they got married to take the trip.

"When we got married, our priority was buying a home," says Divya. "So we just decided we'd put off the honeymoon for a while."

Shared discipline on finances - and a little bit of delayed gratification - have gone a long way for the Aroras, based in West Chester, Pennsylvania, who have saved over $200,000 in assets as they reach their late 20s.

How they save

Sid, 28, moved to the United States when he was 17 and says money was something he kept a close eye on.

"I come from a middle-class background in India where money was a big concern," he says. "In India, it was more about saving money to make sure you could cover your basic utility bills."

He attended the University of Michigan, majoring in computer science. His parents had just moved to Ann Arbor, Michigan and they found that Sid qualified for a big chunk financial aid. So his school loans totaled only about $5,000.

Sid began his career as a software programmer at Intel five years ago, and immediately started contributing to his 401(k). His family had seen their investments plummet during March 2000's dot-com bust, so he was careful to invest his savings in a variety of diversified funds.

Before he met Divya, he used money he had earned at Intel to purchase a home in Arizona, which he would sell three years later for a $130,000 profit.

"I thought about holding onto it as a rental home, but I wanted to sell it at the top of the market," he says.

He met Divya in Punjab, India two years ago and the two hit it off and got engaged. They married in November 2005 in New Jersey, and moved to Pennsylvania to look for a home soon after. He took a job with a technology consulting firm doing programming. Now in his second year with the company, he will soon be eligible for 401(k) matching.

Divya had completed five years of education to become a dentist in India, and worked for a year at a dentistry practice there, but found out that she'd need to take two more years of school in the United States to practice.

So the two knew it would be some time before they'd be able to live with the luxury of two incomes in their household. Until 2009, when Divya begins working full-time as a dentist, the couple will live off of Sid's salary.

Their current priority is their mortgage on their new home and setting aside $800 to $1,000 a month for savings. Sid automatically deducts $500 each month from his paycheck that goes straight to a savings account.

Sid is aiming to make two extra of his biweekly mortgage payments each year, part of the reason the couple have already built up $50,000 in equity in their home after less than a year. The payments total $1,700 a month, and the couple have about $200,000 left on their mortgage. He aims to have the 30-year fixed-rate mortgage paid off in 24 years.

"Every month we plan out our spending, and base our savings around that," says Divya. "We usually save more than $500, and never less than that."

How they spend

On the spending side, the two pride themselves on moderation and long-term thinking. That moderation starts with some very simple things: eating home lunches, not smoking and not drinking.

Sid and Divya believe that small expenses that build up can undermine a budget. They also look out for basics like paying all their bills on time, and using low-interest credit cards.

And their monthly planning session gives them some good perspective about big upcoming expenses ahead. They catalogue all of their upcoming expenses for the month, and use this planning session to determine their savings rate as well.

One expense that the couple is putting on credit is their honeymoon trip to Honolulu, a splurge for which they dropped $5,000 on the flight and cruise.

Other than the debt from the Hawaii trip, the couple has no other credit-card debt.

Another big purchase was Sid's Acura RSX, which he bought new in Arizona in his first year at Intel.

The biggest expense ahead for the couple is Divya's dental school education. In order to become certified to practice in the United States, she needs two years more school (which will bring her dentistry education to a lengthy seven years.) This will cost the couple $120,000, and they won't be able to make a big dent in that until she begins work in several years.

Because it will be difficult for Divya to work while completing her degree, the couple plan to pay off the low-interest student loans after she graduates and begins working full-time.

The future

The couple have big plans ahead, and not just the European vacation they're arranging.

They're planning to continue making extra mortgage payments in order to pay their home off after just 20 years.

Divya plans to complete her dental degree and eventually specialize in endodontics, the treatment of root canals.

Their biggest plans are for middle age, however. Sid would like to be able to leave full-time work, and spend the bulk of his time traveling and being with his family. Divya isn't quite ready to drop out so early after her long education - she says she'll practice dentristy for 25 to 30 years before thinking about working part-time.

As for now, the couple is taking it day to day, they say. But with their constant attention and dedication to the future, their millionaire dreams can't be too far away.

|

|

|

|

|

|

|

|

|

想当理财高手

注册时间: 2005-01-14

帖子: 25

来自: 北京

|

|

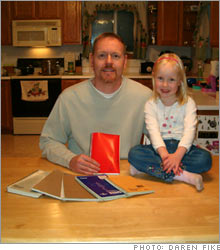

Millionaire in the making: Daren Fike

38-year old widower's good financial sense positions him well for the future .

NEW YORK -- Daren Fike, a business analyst in Colorado Springs, Colo., had always been a saver and a planner.

When his wife Christie passed away suddenly from leukemia in 2003, however, Daren's goals shifted and spending time with his daughter Melody, who was 16 months old at the time, became a priority.

Daren Fike, 38, with daughter Melody, 4, at home with the notebooks.

The father and daughter live 40 miles from Denver, in Colorado Springs, in a house surrounded by 5 acres of land. They have a horse, Cricket, that Daren is just beginning to teach Melody to ride.

"My wife was big into horses," said Fike. "She showed them [competitively]."

They bought their home in 1998 for $199,000 with a 30-year, 7 percent fixed mortgage. In 2003, Fike refinanced to a 15-year, 5.125 percent fixed mortgage.

Fike makes payments on a bi-weekly basis and today owes $124,000 on his home. Fike thinks he can have it paid off by 2012.

Fike's annual income, with death benefits from his wife's previous employer as well as Social Security survivor benefits, hovers around $100,000.

Fike contributes 12 percent of his salary to his 401(k) plan.

His employer, Great Western, contributes another 4 percent in a company match. Fike is fully funding his Roth IRA at $4,000 a year, which has $42,000. He puts $3,000 per year into his taxable Fidelity Brokerage account, which totals $84,000.

Additionally, he has more than $98,000 in two 401(k) accounts - the second one holding funds from a rollover. Fike also has almost $32,000 in mutual funds and $34,000 in an annuity.

All told, Fike has about $290,000 socked away for retirement. He also has $24,000 in an emergency fund earning 5 percent interest with online bank Emigrant Direct.

"In one of my accounts somewhere I have the first dollar I was ever given. It was a dollar I received when I was first born," said Fike, who credits his parents for emphasizing how important saving is.

It's not just Fike's prudent choices but his lifelong saving habits that aid him.

The Notebooks

For years Daren has kept track of his every expenditure in little notebooks. Every 15 days, which coincide with his pay, he totals the amounts. At that time, anything left over in his checking account goes immediately into his savings. The idea is to never have any money left in his checking account at the end of the 15 day period.

When he was in the Air Force, he says, his friends called it the "Fike Strategy."

Fike said he tried to use personal finance software like Quicken but found it too time consuming. "But spending $1.50 every 2 or 3 years for a notebook? It's portable, too."

The simplicity of Daren's financial philosophy extends to his choice in credit cards, too.

Fike has used a Discover Card since he was in college. "I've never paid one penny in interest on the card. When I put everything on that card, I'm getting about $300 back."

Having a 40 mile commute and knowing that gas would be a consistent expense, Fike switched to the type of Discover card that gives 5 percent back on gas.

Fike looks to shave costs off in other areas, too. He makes certain his car isn't carrying any extra weight in its trunk to save gas.

His 1997 Cougar has 185,000 miles on it and he says, "I'm not looking forward to getting rid of it anytime soon. I'll drive it till the wheels fall off."

In addition to the Cougar, which he drives daily, he owns a 2000 Chevy Silverado truck.

Values and plans

"The thing I value most in life is time with my daughter," said Fike. "I would gladly give every cent I have to spend just five more minutes with my late wife Christie so you can be sure I'm not taking the time I have with Melody for granted."

In addition to time spent teaching Melody to ride a horse, Melody takes ice skating and swimming lessons. Fike, a Pittsburgh-native, follows all the Steel City's sports teams closely, too.

By no means is Fike a passive observer of the world. "Since my wife's passing, my emphasis has been on having more life experiences," Fike said.

These days Daren and Melody do a lot of father-daughter activities together such as visiting the park or going bowling.

Last year, they went back to Pittsburgh in June and attended the Steelers Men's Fantasy Camp in Latrobe, Pennsylvania, meeting running-back Jerome Bettis of the Superbowl-winning team.

Daren has also taken up television writing as a hobby. He and a friend are shopping a script around for a dramatic TV show.

Regarding money, Fike says it's "almost like a necessary evil. You have to pay attention to it. The earlier you pay attention to it, the better off you're going to be."

That's why he's teaching Melody about money. "She saves up the money she gets from birthdays and holidays in her piggy bank," he said. "We go together to the bank so she can make her own deposits. She already knows what 'interest' is!"

|

|

|

|

|

|

|

|

|

想当理财高手

注册时间: 2005-01-14

帖子: 25

来自: 北京

|

|

Millionaire in the making: Jerry and Lynn Moser

Age: Jerry 47, Lynn 46

Occupation: Regional sales manager and secretary

Salary: $106,000 combined

Investment accounts: $225K

Checking: $3,000

Home equity: $90,000

Achieving financial security, let alone becoming a millionaire, was a distant dream for Jerry and Lynn Moser 14 years ago. At the time, the yet-to-be married South Dakota couple had battered credit ratings and virtually no savings. Lynn was working two jobs trying to pay down a high credit card balance, while Jerry, recovering from a drug and alcohol addiction, was earning just $6 an hour working in an appliance store warehouse.

Recognizing how dire their financial situation was, the couple, neither of whom earned college degrees, began studying up on money management, learning the fundamentals of personal finance. While Lynn juggled her job and two daughters (now 20 and 16), Jerry logged 60- and 70-hour weeks, working his way up to his current regional sales manager position.

Now the Mosers boast a combined salary of $106,000 and a combined net worth of over $300,000, and they say that their credit rating is in tip-top shape. “We went from disaster to success in a relatively short time,” says Jerry.

What’s their saving secret? Nothing fancy, explains Jerry. The couple contributes 15 percent of their pre-tax income into their respective 401(k) accounts and $2,000 each into their Roth IRAs every year. They carry very little outstanding debt (other than the mortgage on their home), rely on coupons and research long and hard before making any big-ticket buys.

The Mosers are confident they will reach millionaire status by the time they reach their mid-sixties. “The process is in motion,” said Jerry. “All we need is time for our money to compound.”

That goal is well within the Mosers’ reach, and that’s not even including the equity in their home, says Lisa Kirchenbauer, a certified financial planner and president of the Arlington, Virginia-based Kirchenbauer Financial Management & Consulting.

In fact, Kirchenbauer recommends they could even scale back some of the aggressiveness in their portfolio - which has large doses of international stocks as well as energy and real estate funds. A more diversified portfolio would better position them to weather a downturn.

In addition, says Kirchenbauer, they should set a more ambitious goal . “I think to be able to have the comfortable retirement and especially to provide some inheritance, they will need to shoot for something more like $2 million,” says Kirchenbauer.

To do that she recommends that the Mosers increase their retirement account contributions closer to the Federal max - $15,500 for 401(k) and $4,000 each for their individual Roth IRAs. Living in a relatively inexpensive part of the country and with their children almost grown, they have a lot of time to earn and save even more, says Kirchenbauer.

She also notes that the couple should also build up their cash reserves for an emergency fund. In addition, they should ensure that they have a reasonable amount of life insurance and a strategy to cover their health care expenses during retirement.

|

|

|

|

|

|

|

|

|

|

|

前往页面 上一个 1, 2

|

阅读下一个主题

阅读上一个主题

您不能发布新主题

您不能在这个论坛回复主题

您不能在这个论坛编辑自己的帖子

您不能在这个论坛删除自己的帖子

您不能在这个论坛发表投票

|

所有的时间均为 北京时间

|