CaseyChang

年龄: 47

注册时间: 2005-03-15

帖子: 4

来自: New York

|

|

Blended family, tangled finances

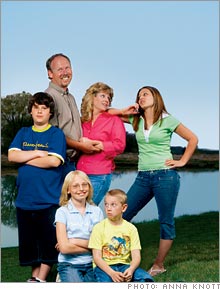

The Cuellars and Garrods

NEW YORK- For their upcoming summer wedding, Tammy Cuellar and Bob Garrod have choreographed every step. Garrod and his two children -- Kelsey, 11, and Matt, 8 -- will be standing under a weeping willow tree near the shore of Bangs Lake, at his parents' home in Wauconda, Ill. NEW YORK- For their upcoming summer wedding, Tammy Cuellar and Bob Garrod have choreographed every step. Garrod and his two children -- Kelsey, 11, and Matt, 8 -- will be standing under a weeping willow tree near the shore of Bangs Lake, at his parents' home in Wauconda, Ill.

Cuellar will emerge from a limousine with her own two children, Alyssa, 14, and J.T., 12. Together the six will walk underneath the cascading branches up to the shoreline. It's the perfect metaphor for a second marriage: two families blending into one.

That much the couple has planned meticulously. Their finances, though, are another matter.

As would anyone in mid-life and mid-career, each brings financial baggage to the marriage. And Cuellar, 37, and Garrod, 43, are carrying a Samsonite or two more than most. She's a planner and budgeter; he's not. She's friendly with her ex; he isn't. She has one philosophy about allowances; he holds another.

Right down the line, the two are as different as can be when it comes to money. "We need help," admits Cuellar. "How do you blend it all? We don't even know where to start."

Feeling overwhelmed by the prospect of joining two financial lives is hardly rare. According to the Stepfamily Association of America, 43 percent of unions are a second marriage for at least one partner, and about 65 percent of remarriages involve kids.

"Blending kids, ex-spouses, money and investment styles -- each one of them requires its own strategy," says Ruth Hayden, a St. Paul financial consultant and author of "For Richer, Not Poorer: The Money Book for Couples." "That's how big a challenge a second marriage is."

The match

Garrod wasn't thinking about financial challenges four years ago when he first spotted Cuellar, who worked in the same building. He'd been saying hi to her in the halls for three months without much luck; she'd barely noticed him. But he finally worked up the nerve to send an e-mail.

From their first date, when they "watched shooting stars until five in the morning," Cuellar recalls, the relationship blossomed. He had divorced in 1998, and she was still going through her breakup, but eventually they proved ready to fall in love again.

Two years ago Garrod moved into her four-bedroom ranch house, which has a backyard pond where he takes the kids fishing in the summer and ice skating in the winter. Then, last Christmas Eve, Garrod slipped a surprise engagement ring under the tree. "I was ready," he says.

Now the courtship has given way to very real challenges, starting with the kids. Although the four have jelled well, J.T. (hers) took the longest to accept the divorce, says Garrod, while eight-year-old Matt (his) sometimes feels left out. And house rules for their two sets don't match: Hers watch TV until falling asleep, and his go to bed earlier.

Allowances too are a potential minefield. Cuellar's children, who live with the couple most of the time, are paid for doing chores like taking out the garbage. Garrod's two, who have shorter visits, don't get a regular fixed amount but still help out around the house.

The next big divide is the couple's finances. Cuellar earns $50,000 a year as a human-resources rep at a life insurance brokerage and gets $850 a month in child support. She has about $60,000 in equity built up in her $285,000 home. Her 401(k) is worth just $1,500, but she's putting in $150 a month. Both kids have a 529 college savings plan, each worth less than $1,000.

"We want to be able to blend all our bank accounts, but I'm a little reserved," says Cuellar. "I have some money, and he's coming in with nothing."

Well, not nothing, but perhaps not what he'd hoped either. Garrod makes $32,600 a year working for the village of Wauconda keeping the streets clear and plowing them when it snows. It's a 50 percent pay cut from his previous job as a computer specialist. Plus he puts 28 percent of his paycheck toward child support.

But after being unemployed for a year, he took what he could get. Between jobs, he spent much of his $22,000 severance. Later he withdrew money from his 401(k) to pay off $12,000 in credit-card debt. In the divorce, his home went to his ex-wife.

Their money habits clash as well. Cuellar works the monthly budget down to the last penny in a spreadsheet.

"Bob's not a money person," says a frustrated Cuellar. "I try to get him to talk about a budget, but he doesn't want to."

The main issue that keeps her fretting at night, however,is what will happen once they combine their finances. Garrod's divorce has been contentious, and the couple wonder whether his ex-wife will have a claim on Cuellar's assets after they marry.

The advice

How does this devoted but challenged couple start on the right path? Beverly Pekala, a Chicago family law attorney, has a simple answer to their most pressing question, which is whether to add Garrod's name to the house title.

"If Tammy doesn't remember anything else, remember this: Don't do it," she says. "I'm going to drive to her house and put up a sign saying NO, NO, NO." One reason is that under Illinois law her house could be considered his asset when it comes to paying for college tuition.

Instead, Pekala says, Cuellar should put her house in a trust -- either an Illinois land trust or a standard revocable trust. She's protected during her lifetime -- from a divorce and other claims -- and can specify that either Garrod or her kids (or both) get the home when she dies.

If Garrod feels slighted, Pekala suggests, he could contribute less to the day-to-day expenses to compensate. But the fact is, "Bob doesn't come to the table with an equal situation," she says. "They have to accept that and act defensively."

Now how can they build a future for themselves and their children? Garrod should never have taken money out of his 401(k), of course.

But now that he has, "all is not lost," says Shashin G. Shah, a financial adviser in Addison, Texas. Garrod is already putting 4.5 percent of his pay into a retirement plan at his new job, but to make up for lost ground he should also fund a Roth IRA (up to $4,000 a year per person). The couple should also set up a $5,000 to $10,000 emergency savings account so they won't make the mistake of tapping retirement kitties again.

To find more money to save -- for one thing, Garrod should start 529s for his kids -- the couple have to reconcile their money habits.

Hayden says Cuellar shouldn't let Garrod off the hook by saying he's "not a money person;" paying the bills together will lead to fewer runs on the ATM. (For more tips, see the next page.)

As for kids, opposite approaches may have worked so far, but it's time to get on the same page. "If she's still taking care of her kids the way she does and he's doing it the way he does, they're not blending," says Hayden. "And kids are smart and will figure out how to manipulate that."

|

|

|

|

|

|